Payroll cost calculator employers

True Cost of an Employee calculator user guide. Include bonuses and taxable.

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

. Employees cost a lot more than their salary. Steps 1 to 3 allow you to enter the direct remuneration costs of an employee. Ad Fast Easy Affordable Payroll Services By ADP.

Payroll So Easy You Can Set It Up Run It Yourself. For example if you earn 2000week your annual income is calculated by. To calculate payroll costs employers generally need to total these expenses.

Ad Payroll Done For You. Taxes Paid Filed - 100 Guarantee. Ad See the Calculator Tools your competitors are already using - Start Now.

Everything You Need For Your Business All In One Place. Understanding federal tax rates post-tax deductions and how to accurately calculate. Ad Fast Easy Affordable Payroll Services By ADP.

Make Your Payroll Effortless and Focus on What really Matters. It is so simple you only need to enter. It will confirm the deductions you include on your.

2995 The Excel spreadsheet calculator includes several more options than the online version. Calculate the cost of hiring someone If you are an employer use our online salary calculator to see exactly how much an employee will cost based on their salary. The calculator will show the company and employee cost for each benefit and calculate taxable wages after pre-tax deductions for payroll taxes.

Free Unbiased Reviews Top Picks. Learn About ADP Payroll Pricing. Ad Easy To Run Payroll Get Set Up Running in Minutes.

The Calculator will show the total payroll cost at the. On top of that the employer will. Search For Employer Payroll Calculator at Bestdiscoveriesco.

Get the Excel version of the Employee Cost Calculator cost. The calculator includes options for estimating Federal Social Security and Medicare Tax. Get 3 Months Free Payroll.

Enter the monthly cost and company. Our payroll cost calculator quickly calculates your total payroll costs including the social insurances and GHS GESY contribution per year. Calculate your startup costs.

In that instance you would calculate gross pay like this 40 hours worked x. The Best Online Payroll Tool. Payroll Tax Calculator Determine the right amount to deduct from each employees paycheck.

Ad Search For Employer Payroll Calculator that are Great for You. Process Payroll Faster Easier With ADP Payroll. Payroll service provider fees Employee wages Employer payroll taxes Unemployment insurance.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. When you think about adding a new employee to your payroll determine what the actual financial cost of doing so means to your business. Taxes Paid Filed - 100 Guarantee.

Plans Pricing How it. The True Cost of an Employee in Ireland in 2022 Calculator is designed to provide insight into the full costing model for employing a new employee in Ireland and together with iCalculators. Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

GetApp has the Tools you need to stay ahead of the competition. Ad Compare This Years Top 5 Free Payroll Software. Our payroll cost calculator quickly calculates your total payroll costs including the social insurances and GHS GESY contribution per year.

The True Cost of an Employee Per Hour 5 Annual Employee Labor Cost Annual Overhead per. It will show you what. Learn About ADP Payroll Pricing.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Payroll 401k and tax calculators. For example if John has a basic salary of 10000 per year and receives an annual bonus of 1000 then his employer has paid him a total of 11000.

Our employee cost calculator shows you how much they cost after taxes benefits other factors are added up. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Process Payroll Faster Easier With ADP Payroll.

Total Annual Payroll Taxes Paid per Employee Learn more about payroll taxes. Get 3 Months Free Payroll. Example of Employee Cost Breakdown.

Summarize deductions retirement savings required taxes and more. Free Unbiased Reviews Top Picks. Ad Compare This Years 10 Best Payroll Services Systems.

40 hours worked x 14 per hour 560 Lets say that same employee worked 45 hours the following week.

Payroll Tax Calculator For Employers Gusto

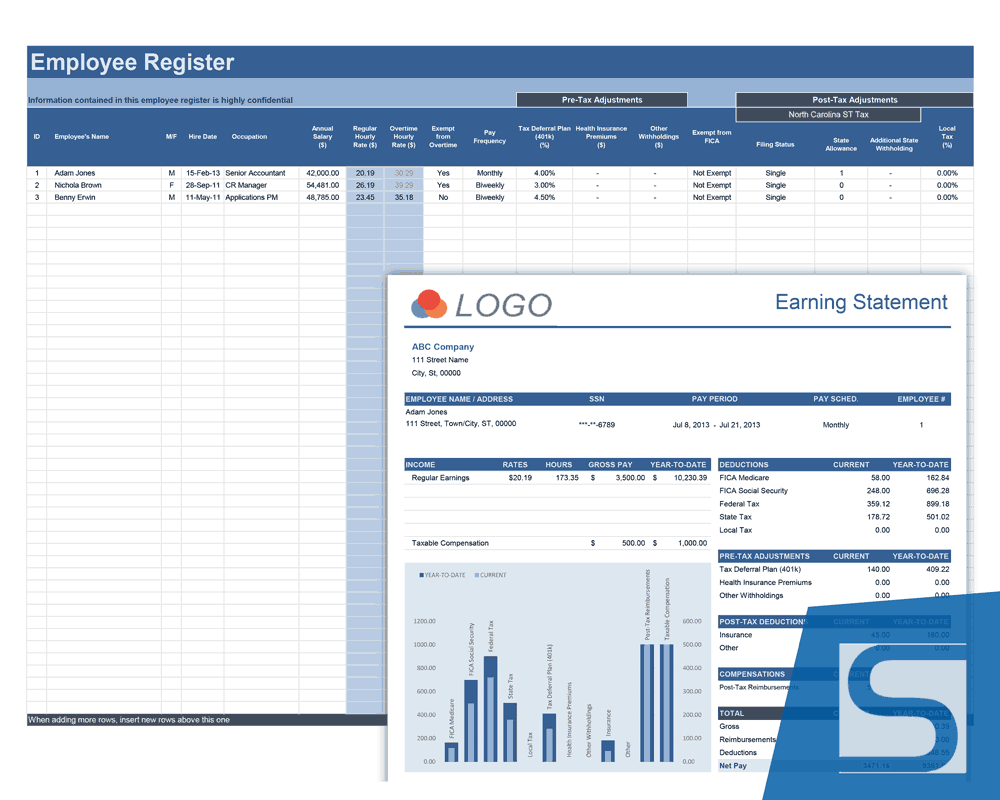

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

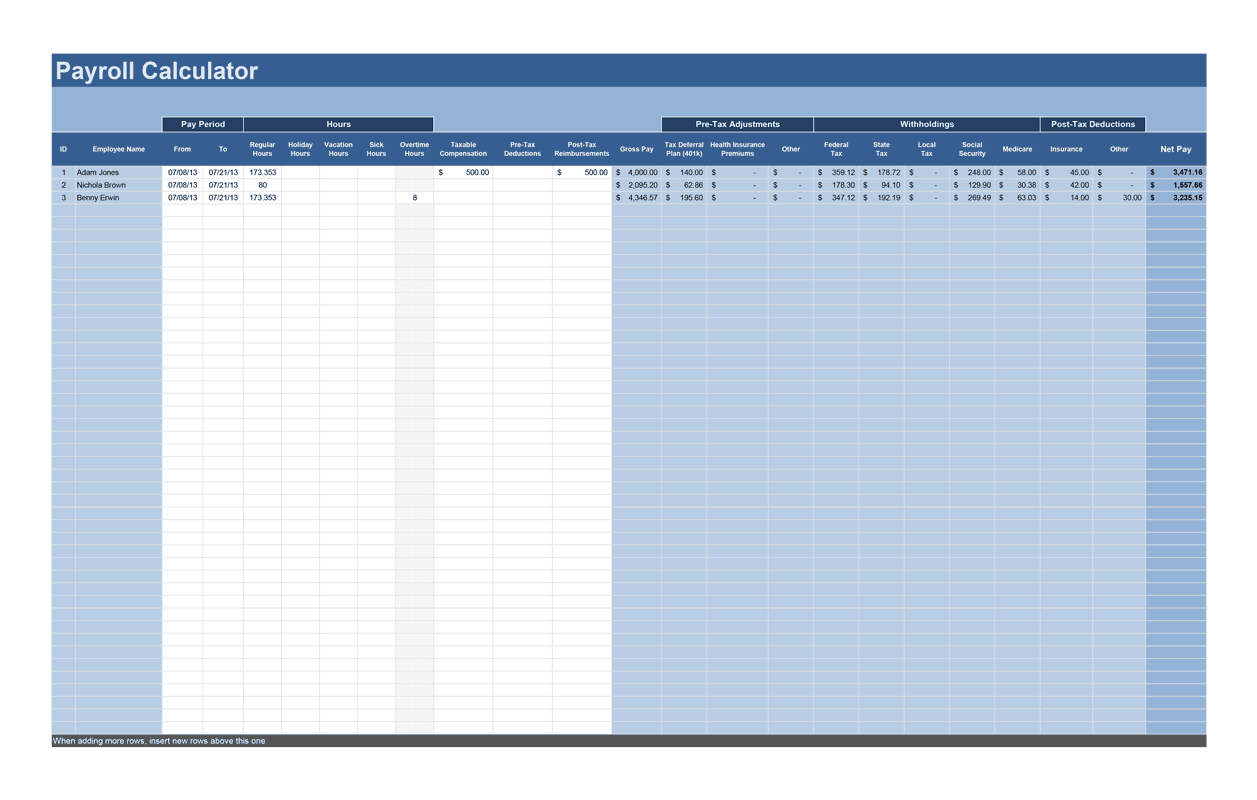

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Calculating Payroll For Employees Everything Employers Need To Know

Pin Page

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

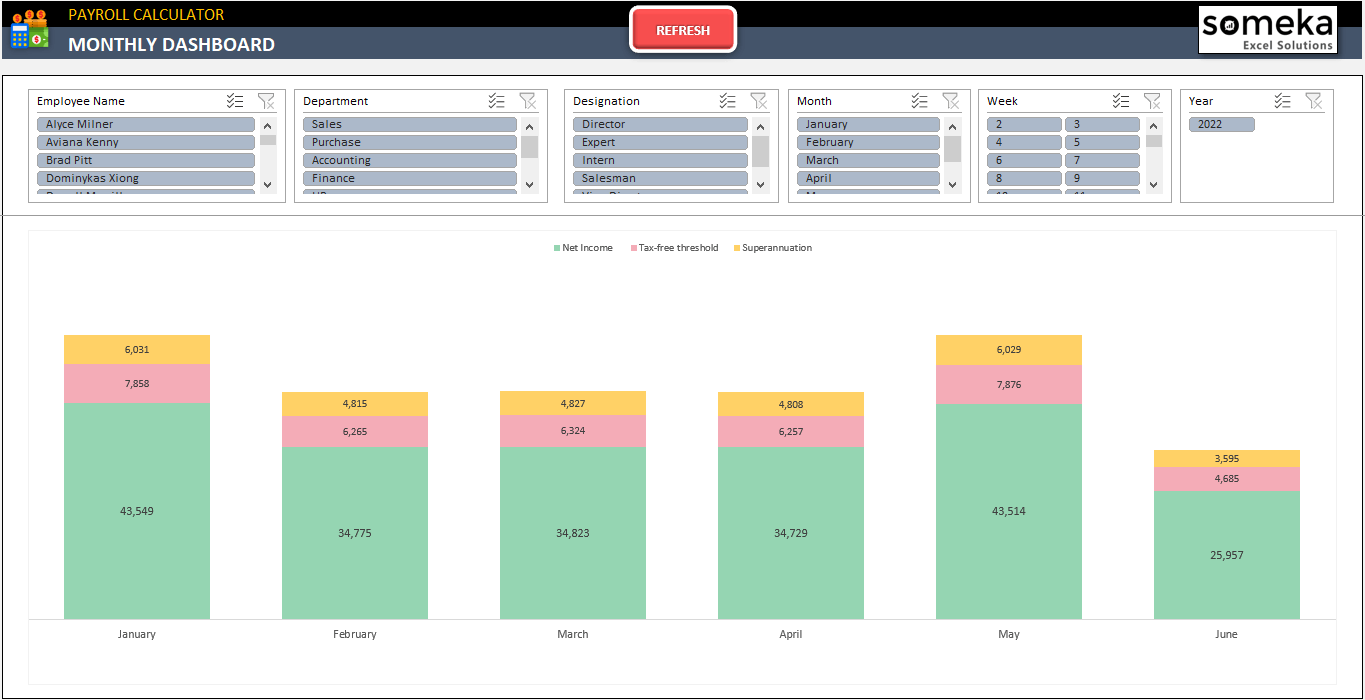

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Shortcuts

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator Free Employee Payroll Template For Excel

Download Total Compensation Spend Rate Calculator Excel Template Exceldatapro Payroll Template Compensation Calculator

Cash Management Payroll 101 What Every Small Small Business Community Cash Management Community Business Payroll

F9bdnsmkp2rpjm

Download Employee Turnover Cost Calculator Excel Template Exceldatapro Employee Turnover Employee Recruitment Employee Onboarding